Resetting Grocery

Current events have challenged the grocery industry like no other. Weeks of demand have been served in days. All of this has happened while companies are ensuring the health and welfare of colleagues and customers facing unprecedented personal challenges.The industry should be congratulated for what’s been accomplished. Now, as we adjust to a “new normal,” two questions spring immediately to mind: Shopper needs have changed, so should the customer experience also adapt? And with current operational challenges, is anything new just a distraction?

For many, the focus will continue to be on day-to-day operations, while we wait to see what societal changes will be temporary versus permanent. The experience of previous recessions, however, tells us that those that adapt and balance efficiency with investment are more likely to win share in any recovery.

From global research we have fielded within the past month, we can gain insight into the current consumer mindset in the United States, which compared with other countries tends to be more self-centric and conservative:

- The U.S. consumer feels more alone than many, up 20 percentage points versus the global consumer

- Being forced to live digitally reinforces the value of face-to-face, up 15 percentage points

- The crisis should not change our standards on privacy, up 25 percentage points

- I am keen to get back to my lifestyle before the virus hit, up 10 percentage points

- With today’s stresses I need to focus on me, here, now (versus society), up 25 percentage points

Even if behaviors do not change permanently, the impact on aviation of the terrorist attacks of Sept. 11, 2001, provides a sense of possible short-term disruptions: Scheduled passengers dropped 8% in 2002 compared with 2000. By 2004, however, passenger numbers were above the 2000 level and grew strongly thereafter.

Necessity is the mother of innovation. We are seeing an explosion of new business models to meet the demand that traditional retail alone has not been able to fully serve. While the majority of these new designs ultimately will fail, the experimentation will almost certainly surface new competitors that will present a future threat to growth.

INNOVATION 1: ACCELERATION OF DIGITAL

Acosta’s research shows that 28% of online grocery shoppers made their first online grocery order in the past four weeks. For many, however, the experience has been unsatisfactory. Some grocers are making shoppers queue to enter their digital store. Even digital natives lack sufficient delivery slots, so shoppers must manually check daily or even hourly to secure delivery. Nine out of 10 shoppers have experienced out-of-stocks, and 53% of shoppers could not find a substitute for half or more of their unavailable items.

At present, the customer experience is being driven by operators managing hyper demand. Expect to see some providers quickly adapt to being more customer-centric, however: cloud scaling to ensure the store is always open, larger inventories to reduce stock-outs, smarter substitution algorithms and picking routines, and automated allocation of future delivery slots to reduce anxiety and work for shoppers.

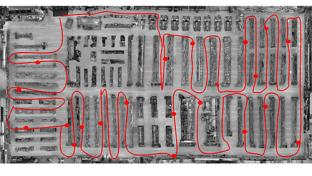

Physical retail retains an advantage for digital fulfillment, as it can use existing assets, close to consumers, that can be picked without incremental investment. Its ship to store enables scaling capacity with little additional investment. As for larger stores, developing contactless curbside pickup enables a new definition of convenience for both shoppers and home delivery intermediaries.

INNOVATION 2: WHOLESALE ENTERS RETAIL

The wholesale channel has seen a collapse in sales of up to 90%, according to The Los Angeles Times. While retail continues to see a lack of availability, there’s an abundance of product in wholesale that’s going to waste. This is driving innovation to match supply with demand.

Jupiter.co provides subscription home delivery, providing a retail intermediary for groceries and essentials. Panera Bread has launched Panera Grocery, spanning produce, dairy and bakery. Oberweis likewise has expanded into new categories like meal solutions, beyond its core of dairy.

Restaurants such as Just Salad, starved of their core business, also are expanding into a breadth of home delivery services, from grocery to meal kits, building on their “all-natural” authority to move beyond raw ingredients. This accelerates a trend that was already in motion, with the rise of UberEats and Doordash, of restaurant meals for the home. With existing infrastructure for ordering online and curbside pickup, these operators may capture a profitable niche.

INNOVATION 3: SHOPKEEPERS RETURN

The outage in slots and products has led people to explore other options. Advances in SME (small-to-medium enterprise) payment mean that logistics and digital solutions have become a great leveler, enabling specialists to compete once more with the scale of the supermarket. A major barrier had been the hassle of signing up to multiple providers. Once they’ve overcome that hurdle, however, specialists may find that online ordering from several focused suppliers is easier to browse than a single supermarket with tens of thousands of alternatives to sort through onscreen.

Could this see us returning full circle to visiting the butcher, the baker or the fishmonger? Category specialists, such as Chewy for pet food, also will benefit from their depth of supply and focus. It won’t be an overnight change, but fintech does suggest that the customer experience from specialist providers is superior to the one-stop-shop complexity of full service.

INNOVATION 4: RESURGENCE OF NATIONAL BRANDS

“Americans are craving comfort food” was the headline of a recent USA Today article. With anxiety and boredom rampant, people are rediscovering the national brands of their youth. General Mills, Kellogg, Nestlé, Conagra and Kraft — brands that had been in decline — are seeing a reversal of fortunes. While the lift may be temporary, a long tail is likely as people repeat the struggle of moving to healthier and more natural ingredients.

Additionally, growth in private label has been a lifeline for grocers seeking new sources of margin enhancement. The current generation, such as Target’s Good & Gather, Kroger’s Simple Truth, and ShopRite’s Bowl & Basket, have brought provenance and “healthier” to the forefront of their branding. A possible reset of consumer priorities, even if for a few years, could be a valuable source of funding.

HOW TO ACT DURING UNCERTAINTY

A recent Harvard Business Review article, “Roaring Out of Recession,” looked at the outcomes for different company strategies from the past three recessions, and found that companies that applied the “Janus” strategy were consistently the most successful. Specifically, these companies combined managing cost through operational efficiency with an investment in market development and asset investment.

The uncertainty in possible outcomes provides a risk for all grocers’ current business models. Rather than seeing uncertainty as a reason to stick with what you know, however, it’s a major risk that the current business model no longer meets future shoppers’ needs. Now is exactly the time to lean into the uncertainty by moving fast to try new concepts and reposition to where shoppers will be, not where they once were. If we were to point to one theme above all others, it would be the redefinition of “convenience.” Whoever solves this, at an affordable price, could redefine grocery for a generation.

As we move beyond the first month’s operational chaos, consider creating a skunkworks project with a cross-functional team. Charge that team with developing a perspective on possible recovery outcomes, such as recovery by year-end versus a deep recession powered by a two-year event. Look to the innovation in the market and how ideas could be adapted. Use accelerated insight techniques to rapidly assess hypotheses with consumers in their homes. Don’t be led by their answers – they can’t predict their future behavior – but do be informed by the challenges they face and what adaptations they’re making to address those challenges. Use scenarios and consumer insights to identify and prioritize ideas that respond to the current new normal and that can reset the business design for future recovery. Use design sprints to rapidly pilot ideas to assess demand and feasibility. Be comfortable with failure, and recognize that this still informs what will be ready to scale as the recovery begins.

By making these smart investments to trial new solutions, innovative grocers will be 12 to 18 months ahead of competitors. Delaying investment and relying on a fast-follower strategy, on the other hand, will risk a permanent loss of share. We believe that the current uncertainty provides the kind of market turbulence that strong leadership can use to win the customer of the future.