Digital Sales Declined in 2023, as Pickup Held Steady

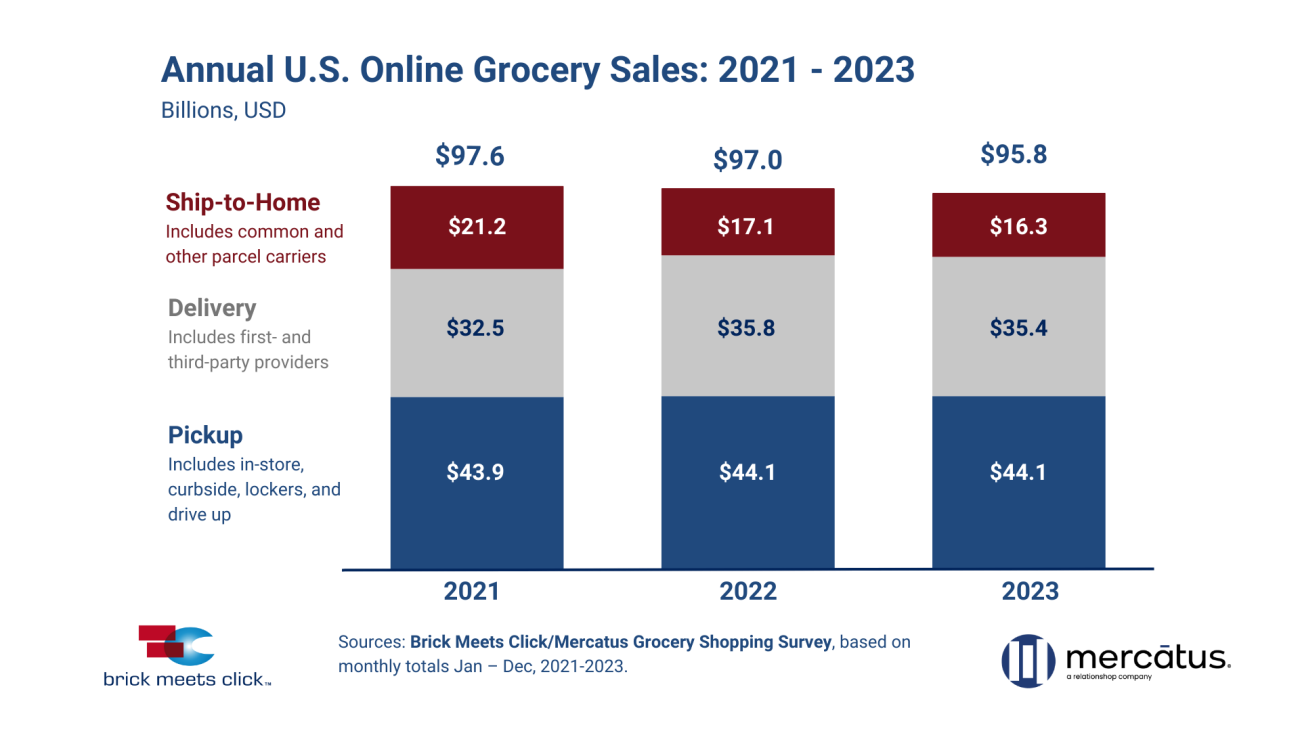

E-commerce sales slowed a bit in 2023 but pickup remains a bright spot for food retailers, according to the latest Brick Meets Click/Mercatus Grocery Shopper Survey. Total online sales reached $95.8 billion in the recently-concluded calendar year, down 1.2% from 2022.

The decrease was attributed in part to lower order frequency among online shoppers. The data shows that the average number of monthly e-grocery orders slid 6% in 2023, following a 4% year-over-year dip in 2022.

[Read more: “Hannaford Offers Free Grocery Pickup"]

Grocers’ share of e-comm sales also contracted for the year, the survey revealed. The monthly active user (MAU) base rose 15% in the mass channel and 12% in the discount channel, while shrinking 4% in the supermarket channel.

While sales and usage decreased, the data showed that consumers continue to embrace pickup as a mode of order fulfillment. Brick Meets Click and Mercatus reported that pickup grew its share of e-grocery sales by 56 basis points to comprise 46% of the digital market in 2023. Delivery declined by 0.9% and ship-to-home edged down by 4.9% in that 12-month period. In another indicator that shoppers are diversifying their purchases, the cross-shopping rate between grocery and mass formats went up last year by 150 basis points.

“These annual results show that 2023 was very challenging for grocery retailing as higher prices chipped away at household purchasing power even though inflation has slowed considerably since its peak in 2022,” said David Bishop, partner at Brick Meets Click. “Despite the challenges, pickup continues to prove its appeal to shoppers, even without the benefits of expanded availability and/or aggressive promotions that aided delivery in 2023.”

Added Mark Fairhurst, global chief growth officer at Mercatus: "As Walmart grabs market share through its price leadership and omnichannel strategies, regional grocers find themselves in a precarious position. To remain competitive, they must intensify their efforts in improving customer engagement, offering tailored personalization, and building loyalty. This strategic shift is not just about weathering the storm of price inflation and intense competition, but about thriving in it.”